Let’s get to work.

Let_s_get_to_workChapter

Okay!

You’ve read a lot.

I hope you’ve learned a lot.

I hope you’ve gotten wise

to many of the shenanigans

that automobile insurance companies

try to pull.

Now let’s gather your supporting documents.

Then let’s get to work on your letter

to the automobile insurance company.

In this module, I take you through

the next few tasks at hand

in this order:

If you do not have a copy

of the Monroney Label window sticker

for your total-loss vehicle,

then get a PDF of it

from monroneylabels.com for $9.99.

Or, if you already have a paper copy

of your total-loss vehicle’s

Monroney Label window sticker,

take a photo of it with your cellphone.

You’ll want to attach a PDF or a jpg

of your Monroney Label window sticker

to the email that you send

to the automobile insurance company.

Use your Monroney Label window sticker

to get your total-loss vehicle’s

exact J.D. Power Buy from Dealer Price.

If you choose to use one of my model letters

as the starting point for your letter

to the automobile insurance company,

then let’s go down this path:

In your word-processing software,

use “Find and replace” ➞ “Replace all”

to change the specifics

of my model letter

to the specifics

of your total-loss claim.

Thereby, you will turn my model letter

into your draft letter.

Edit your draft letter

to make it consistent

with your total-loss vehicle’s

J.D. Power valuation.

Then edit your draft letter

to make it consistent

with the market valuation report

that you received

from the automobile insurance company.

If your total-loss claim

is a first-party claim,

then edit your draft letter

to make it consistent

with what

your automobile insurance policy says.

At the end of your draft letter,

make a note of any questions

that you wish to ask the attorney

when you meet with her or him.

(I already have some questions there

that you may wish to ask the attorney.)

After you complete these tasks,

you’ll be ready to go

to the next module.

In the next module,

you can check, vet, and edit

your draft letter

against my excerpts

of the laws of your state

that regulate

how automobile insurance companies

that do business in your state

are required to value total-loss vehicles

and settle total-loss claims.

Just one last thought

before we get to work:

Let_s_get_to_workChapter

Might you want to invite someone

who believes in you

to be your co‑pilot

and share this learning adventure

with you?

I’m doing everything that I can think of

to support you and encourage you

in your fight to get a fair valuation

of your total-loss vehicle.

Even so, most of us find any new undertaking

less arduous and more enjoyable

if we share the experience in person

with someone who believes in us,

who encourages us,

and who bolsters our self confidence.

If you have the good fortune

to have a friend, relative,

or significant other

who likes to encourage you,

support you,

and see you succeed;

then might you want

to invite her or him

to be your co‑pilot

and share this adventure with you?

The two of you could

learn together,

share the work,

share the thinking,

share the drama,

and in the end—

I do believe!—

share the victory.

If you have multiple people to choose from,

you might want to pick someone

who is strong where you are weak.

If you have a lot of courage

but you don’t have a lot of computer skills,

then enlist someone who has computer

and word processing skills.

She or he need not supply any courage.

Or, if you have computer skills

and word processing skills,

but you haven’t yet tapped into

your ability to confront and challenge

people who are out to cheat you,

then enlist someone

who meets challenges head on

and lets the fur fly.

She or he need not have

the computer skills that you have.

If you team up with your opposite,

you’ll learn a lot from one another.

Heck!

If you have a tendency

to let people in suits push you around,

enlist as your co‑pilot

someone who is downright scary!

She or he will be flattered.

When you’re dealing with people

who are out to cheat you,

being scary has its benefits.

Maria can be downright scary.

Maria’s a New York City Latina.

I can be a little scary.

But I cannot be

as scary as a New York City Latina.

With the right role model,

you too can learn to be scary!

When you’re dealing with people

who are out to cheat you,

being kinda scary can be kinda fun!

Don’t be shy.

If there’s someone you know, like, and trust

who would like to help you

get more money

for your total-loss vehicle,

give her or him a call.

Better yet, invite the person

whom you’re thinking of

to meet for coffee.

Pay for their coffee!

Sell this wonderful person on learning

what you’re learning!

Sell her or him on being your co‑pilot.

The takeoff point is now!

might_you_want_to_enlist_a_co_pilotChapter

If you have a paper version

of the Monroney Label window sticker

for your total-loss vehicle,

take a photo of it with your cellphone.

If you do not have

a Monroney Label window sticker

for your total-loss vehicle,

let’s get a PDF of one

from monroneylabels.com for $9.99.

To get the exact

J.D. Power Buy from Dealer Price

for your total-loss vehicle

we’re going to use

a Monroney Label window sticker.

We’re going to attach

either a jpg photo or a PDF

of the Monroney Label window sticker

for your total-loss vehicle

to the email that you use

to send your letter

to the automobile insurance company.

If you have a paper copy

of the Monroney Label window sticker

for your total-loss vehicle,

take a photo of it with your cellphone.

If you do not have

a Monroney Label window sticker

for your total-loss vehicle,

then you can buy one.

To buy a Monroney Label window sticker

for your total-loss vehicle

from monroneylabels.com for $9.99,

click www.monroneylabels.com.

Select your total-loss vehicle’s model year.

Select your total-loss vehicle’s make.

Type in your total-loss vehicle’s VIN number.

Click Submit.

Create a new customer account.

Pay.

Place your order.

MonroneyLabels emails you a receipt.

Open the receipt.

Look for the link that ends in “pdf”.

Click the link

or copy and paste it into a browser.

Download the PDF.

Create a new file folder.

Name the new file folder Attachments_To_First_Email.

Save the Monroney Label PDF to your

Attachments_To_First_Email

file folder.

When you save the Monroney Label PDF,

make your total-loss vehicle’s VIN number

the first part of the filename.

Make the rest of the filename:

Total_loss_vehicle_Monroney_Label_MSRP_$XX,XXX.pdf

where $XX,XXX is your total-loss vehicle’s MSRP.

Your pdf’s filename should look a lot like my model pdf’s filename:

1C4PJMJX2KD249619_Total_loss_vehicle_Monroney_Label_MSRP_$41,560.pdf

“Jerry, why on earth put the MSRP

in the filename?”

Couple of reasons.

If you have a right of recourse

and you exercise it,

you’ll be searching

at automobile dealerships

for vehicles that are substantially similar

to your total-loss vehicle.

A lot of automobile dealerships

offer free CarFax Vehicle History Reports

on the vehicles that they have for sale.

Usually, a free CarFax Vehicle History Report

includes a Monroney Label window sticker

for the for-sale vehicle.

The Monroney Label window sticker

includes the for-sale vehicle’s MSRP.

If a candidate right-of-recourse vehicle

has an MSRP

that is close to your total-loss vehicle’s MSRP,

then that’s a quick and easy indication

that the candidate right-of-recourse vehicle

is substantially similar

or at least similar enough

to your total-loss vehicle

to use that vehicle for valuation purposes.

If you put each vehicle’s MSRP

in the filename of its Monroney Label pdf,

then, to see what a vehicle’s MSRP is,

you won’t need to open the file.

You’ll be able to see the MSRP

for every vehicle

in your file directory.

Your search

for substantially similar vehicles

or similar enough vehicles

will go much faster.

Further down the line, if you sue

the automobile insurance company

and your judge or court arbitrator

reads your letter

to the automobile insurance company,

then he or she likely will notice

that the actual cash value

that you are asking for

is a lot less money

than your total-loss vehicle’s MSRP.

Conclusion?

You’re not greedy.

You’re reasonable.

Let_s_get_a_Monroney_Label_window_sticker_for_your_total_loss_vehicleChapter

Let’s get the exact

J.D. Power Buy from Dealer Price

for your total-loss vehicle.

On a printout of the Monroney Label

for your total-loss vehicle,

circle the options

that J.D. Power considers to be

major options.

If, earlier, you got a ballpark

J.D. Power Buy from Dealer Price

for your total-loss vehicle,

I suggest that you run the valuation again.

This time, work

from the Monroney Label window sticker

for your total-loss vehicle.

Do your best to get the exact

J.D. Power Buy from Dealer Price

for your total-loss vehicle.

We’ll get the two valuation PDFs

that you’ll want to attach

to your email

to the automobile insurance company:

-

The J.D. Power Buy from Dealer Price

-

The specs that you used to get

the J.D. Power Buy from Dealer Price

The vehicles and prices

in J.D. Power’s database

change over time.

Hence, J.D. Power valuation amounts

bounce around over time.

You may want to run the valuation

several times over a week or two

and use the report

that has the valuation amount

that best serves your purpose.

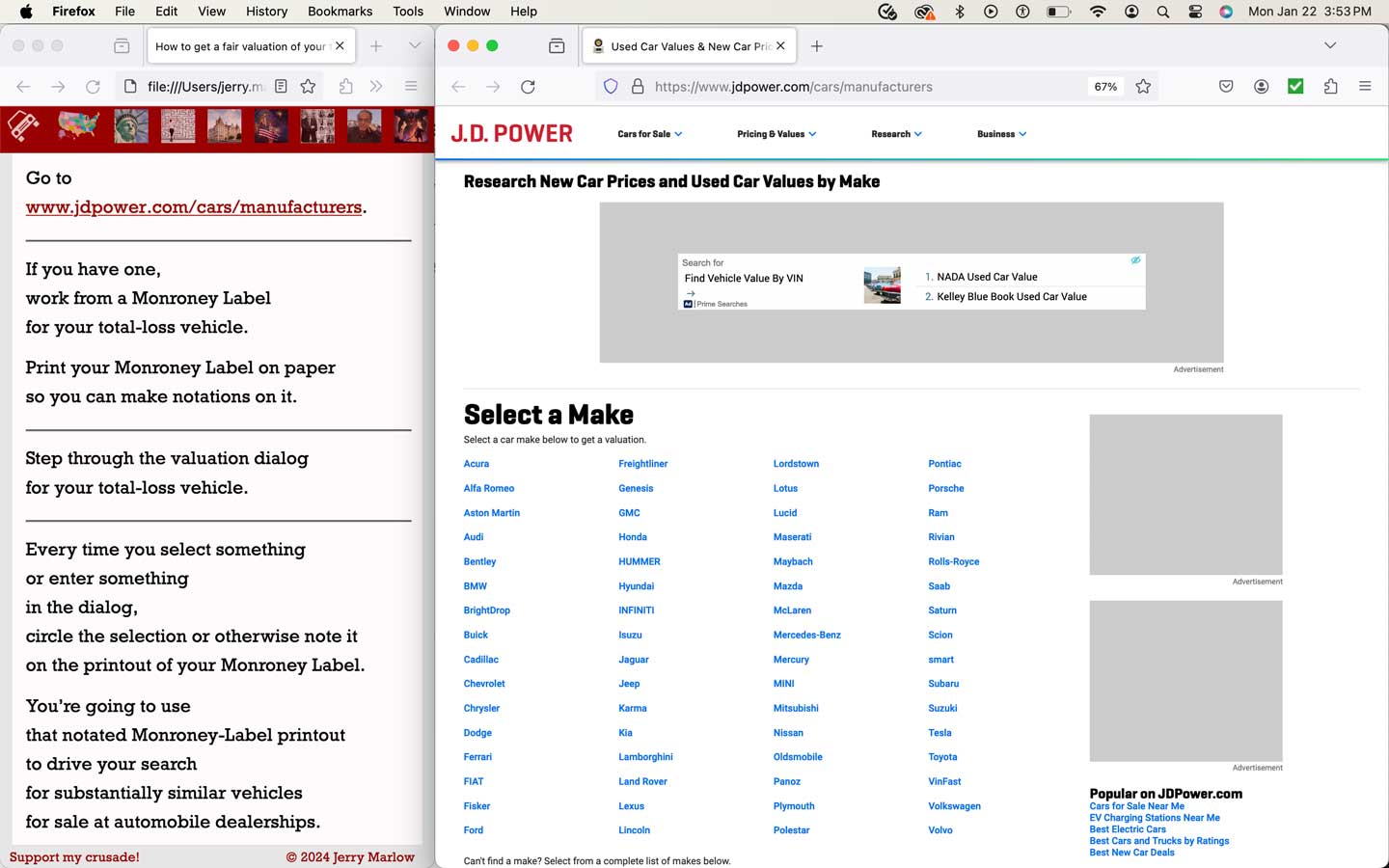

When www.jdpower.com/cars/manufacturers opens

in a new browser window,

arrange your browser windows

something like this:

Go to

www.jdpower.com/cars/manufacturers.

Work from your Monroney Label

for your total-loss vehicle.

To keep track

of the vehicle specs that you have entered

and of the specs that you have not entered,

I suggest that you

print your Monroney Label on paper

and make notations on it.

Step through the valuation dialog

for your total-loss vehicle.

Every time you select something

or enter something

in the dialog,

circle the selection or otherwise note it

on the printout of your Monroney Label.

Your total-loss vehicle’s Monroney Label

with your notations on it

could come in handy later

if you exercise your right of recourse

(if you have one)

or if you have some other reason

to search for substantially similar vehicles

for sale at automobile dealerships.

Under Select a Make,

select the make of your total-loss vehicle.

Circle the make on your Monroney Label.

Under Select a __________ Model,

select the model year.

Circle the model year

on your Monroney Label.

Select “All Body Styles.”

I find the dialog works best

if you select All Body Styles

and scroll all the way down the page

until you find the body style

of your total-loss vehicle.

Once you find your vehicle’s body style,

select it.

Don’t let the interruption of an ad

make you think that you’ve reached

the bottom of the page.

Circle the body style

on your Monroney Label.

Under Select a ___ ____ ____ trim,

select the trim level.

Circle the trim level

on your Monroney Label.

Under Enter Zip Code,

enter the ZIP Code of the location

where you most often parked or garaged

your total-loss vehicle.

Write the ZIP Code on your Monroney Label.

Under Enter Mileage and Select Options,

enter your total-loss vehicle’s mileage.

Write the mileage on your Monroney Label.

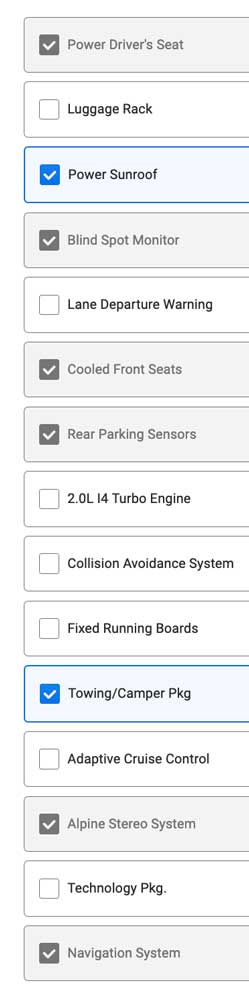

Select Select Your Options.

CarFax will select for you options

that it expects your total-loss vehicle to have.

You may or may not need

to un-select some of those.

Select your total-loss vehicle’s major options.

Work from the list of options

on your Monroney Label.

Options can have weird names.

The word or words

that J.D. Power uses for an option

may not be the same word or words

that your Monroney Label uses.

If you do not know what an option

listed on your Monroney Label is,

Google the year, make,

and model of your vehicle

plus the Monroney-Label name of the option.

For example, the Monroney Label

for Maria’s total-loss vehicle included:

“Auto-Dimming Interior Mirror w/HomeLink.”

What the heck is a HomeLink?

Neither one of us knew.

When we Googled 2019 Mazda3 HomeLink,

we were able to figure out that what

the Monroney Label called HomeLink

was the same thing

that J.D. Power called

a “Universal garage door opener.”

In some way, make a record

of the major options

that your total-loss vehicles has

and J.D. Power asks about.

On your Monroney Label,

you may want to circle each major option

that J.D. Power asks about

that your total-loss vehicle has.

Or you can take a screen capture

of the major options

that the J.D. Power calculator uses

to value your total-loss vehicle.

“Why bother?” you might ask.

In your negotiations

with the automobile insurance company,

or in an arbitration proceeding

with the automobile insurance company,

or in court;

you might possibly get into an argument

with the automobile insurance company

about whether or not a certain option

is a major option.

I would like for you to be able to say,

“In deciding which options are major options,

I did not rely on my personal judgement.

“I relied on which options J.D. Power—

the automobile valuation company—

considers to be

the important or major options

for the purpose of valuing

a used automobile.

“For my total-loss vehicle,

J.D. Power does not consider this option

to be a major option.”

Or, as the situation may call for:

“For my total-loss vehicle,

J.D. Power considers this option

to be a major option.”

Here, from a screen capture

of the J.D. Power valuation dialog,

with check marks,

are the major options

that J.D. Power asked about

that my fictitious total-loss vehicle had.

When you finish selecting

and, in some way, recording

your total-loss vehicle’s major options,

click Next.

Under Pricing & Values,

J.D. Power reports two types of values:

-

A buy-from-dealer average price paid

-

Trade-in values

Most likely, your state’s laws recognize

that you the total-loss claimant

are in the position of a retail buyer.

Hence, the relevant J.D. Power valuation

is the “Buy from Dealer Price.”

On the J.D. Power screen,

on the same line that says

“Values” “Specifications,”

look over on the right for “Print.”

Print the values on paper.

Print the values as a PDF.

Make your total-loss vehicle’s VIN number

the first part of the filename.

Make the rest of the filename

_Total_loss_vehicle_JD_Power_Value_$XX,XXX.pdf.

Replace $XX,XXX with the J.D. Power valuation amount

for your total-loss vehicle.

Save this valuation PDF to your

Attachments_to_first_email folder.

Click “Specifications.”

To print a PDF of all the specifications,

before you print,

for some of the clusters of specifications,

you have to click the +

that is next to each and every cluster

of specifications.

Print the specifications on paper.

Print the specifications as a PDF.

Make your total-loss vehicle’s VIN number

the first part of the filename.

Make the rest of the filename

_Total_loss_vehicle_JD_Power_Specs.pdf.

Save the specifications PDF to your

Attachments_to_first_email folder.

In your computer’s file directory,

in the Attachments_to_first_email folder,

sort the files by name.

The names of the three PDFs

that you’ve saved thus far

should look a lot like

the names of three of the PDFs

that I attached to my model email:

Let_s_get_the_exact_jdpower_retail_priceChapter

The attachments that you have thus far should look something like this:

Let’s edit

one of my model letters

into a draft letter

that you can ask an attorney

to review, vet, edit, and strengthen.

Earlier you read models of the letters

that I might send today

to an automobile insurance company

to get a fair valuation

of my total-loss vehicle.

My model letters are generic letters.

If you’re going to use

one of my model letters

as the starting point

for your letter

to the automobile insurance company,

then you need to make changes

to that model letter.

I wrote the model letters in my name.

You need to change my name to your name,

my address to your address,

my email address to your email address,

and so on.

I based my model letters on

a make-believe insurance company,

a make-believe total-loss vehicle,

a make-believe total-loss claim,

and a make-believe

valuation-services vendor.

You need to change

these make-believe specifics

to your total-loss claim’s specifics.

I based the model letters

on a make-believe market valuation report.

Where my model letters

are not consistent

with the market valuation report

that you received

from the automobile insurance company,

you or your attorney needs

to make your draft letter consistent

with the market valuation report

that you received.

For the first-party-claim letter,

I based the model letters

on a make-believe

automobile insurance policy.

If your total-loss claim is a first-party claim

and my model letters are not consistent with

what your automobile insurance policy says,

then you or your attorney needs

to make your draft letter consistent with

what your automobile insurance policy says.

My model letters are consistent

with my understanding

of the laws of many states.

However, the laws of the fifty states

differ from state to state.

Where my model letter is not consistent

with the laws of your state,

you or your attorney will need

to make your draft letter consistent

with the laws of your state.

Some of the necessary changes

you can easily make yourself.

Some you likely will want to leave as is

and, when you meet with an attorney,

let her or him make the necessary changes.

To make it easy and efficient

for you and your attorney

to edit and modify

my model letters and emails,

I created two Word.docx documents:

Marlow_First_party_Not_yet_settled_letter.docx

and

Marlow_Third_party_Not_yet_settled_letter.docx

I made my instructions, suggestions,

and comments part of each document.

After you complete the instructions

and follow or consider my suggestions,

you can delete

those instructions and suggestions

from the document.

You can resolve

some of my comments yourself.

Those comments that you resolve,

you can delete.

You can save some of my comments

for your attorney to consider.

At the end of my model letters,

I typed in additional questions

that you may find it useful

to know the answers to

if the automobile insurance company

does not agree to the valuation

of your total-loss vehicle

that you propose in your letter.

The answers to some of these questions

you may be able to find

when you read

the laws of your state that regulate

how automobile insurance companies

that do business in your state

are required to value total-loss vehicles

and settle total-loss claims.

Any questions

that you cannot answer yourself,

you can ask the attorney

when you meet with him or her.

When you’re ready to do so:

If your total-loss claim is a first-party claim, download

Marlow_First_party_Not_yet_settled_letter.docx

and start turning my model letter

into your draft letter.

If your total-loss claim is a third-party claim, download

Marlow_Third_party_Not_yet_settled_letter.docx

and start turning my model letter

into your draft letter.

After you edit your draft letter

to make it consistent

with your total-loss vehicle’s

J.D. Power valuation,

consistent with the market valuation report

that you received

from the automobile insurance company, and,

if your total-loss claim

is a first-party claim,

consistent with what your automobile insurance policy says;

come back to wasyourcartotaledorstolen.com.

Click the map of the USA.

Then click your state.

Check, vet, and edit your draft letter

against my excerpts of your state’s laws.

If, at any time,

you feel a warrior’s impulse

to help me

help other everyday Americans

fight back

against automobile insurance companies

that are out to screw us all,

at the top right of your screen,

Send me a few dollars.

let_s_edit_model_letter_and_email_into_draft_letter_and_emailChapter

Nota bene

Jerry Marlow is not an attorney. Neither information nor opinions published on this site constitute legal advice. This site is not a lawyer referral service. No attorney‑client or confidential relationship is or will be formed by use of this site. Any attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service.

Terms of use

Jerry Marlow grants human users of wasyourcartotaledorstolen.com permission to use the copyrighted materials on wasyourcartotaledorstolen.com for their personal use free of charge.

The fee to use copyrighted materials on wasyourcartotaledorstolen.com to train artificial intelligence software (AI) is $4 million.

Reproduction of copyrighted materials on wasyourcartotaledorstolen.com for commercial use without the written permission of Jerry Marlow is strictly prohibited.

Jerry Marlow does not grant users permission to reproduce on other websites any of the copyrighted material published on wasyourcartotaledorstolen.com.

Jerry Marlow does not grant users permission to reproduce via audio, video, or any other audiovisual medium any of the copyrighted material published on wasyourcartotaledorstolen.com.

If you wish to use any of the copyrighted material published on wasyourcartotaledorstolen.com in any way for which permission is not explicitly granted, contact Jerry Marlow at jerrymarlow@jerrymarlow.com.