What I would do today

to get a fair valuation

of my total-loss vehicle

if I had not yet agreed

to a valuation amount.

If I had not yet agreed

to a valuation amount

for my total-loss vehicle,

then, first, I would try to negotiate

a fair valuation of my toal-loss vehicle.

I would attack and reject the valuation

in the automobile insurance company’s

CCC market valuation report.

I would try to persuade

the automobile insurance company

to value my total-loss vehicle

at its J.D. Power Buy from Dealer price.

I would argue

that my total-loss vehicle’s

J.D. Power Buy from Dealer price

is a fair, reputable, and unbiased calculation

of my total-loss vehicle’s

actual cash value.

what_I_would_do_todayChapter

Your total-loss vehicle’s

actual cash value

is the amount of money

including sales tax

for which you

can reasonably be expected

to replace your total-loss vehicle

with a vehicle

that is substantially similar

to your total-loss vehicle.

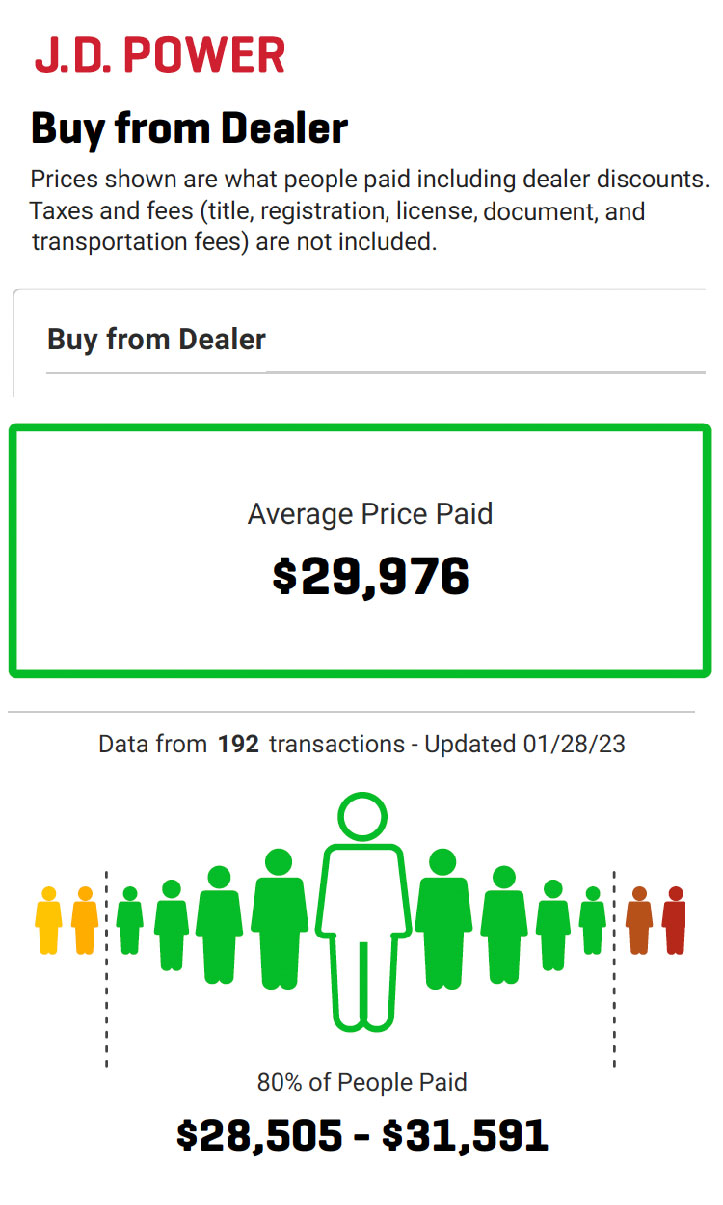

The J.D. Power online calculator

calculates the average price

that vehicles substantially similar

to your total-loss vehicle

sold for recently

at local automobile dealerships.

The J.D. Power Buy from Dealer price

for your total-loss vehicle

plus sales tax is a fair,

unbiased, and accurate calculation

of your total-loss vehicle’s

actual cash value.

If your total-loss claim

is a first-party total-loss claim,

then your automobile insurance policy

likely promises

that your automobile insurance company

will value your total-loss vehicle

at its actual cash value.

If your total-loss claim

is a third-party total-loss claim,

then the insurance regulations of your state

may require

the automobile insurance company

that you’re dealing with

to value your total-loss vehicle

at its actual cash value.

What does actual cash value mean?

How do you calculate it?

Actual cash value

is insurance-industry jargon.

Your total-loss vehicle’s actual cash value

is the amount of money including sales tax

for which you the claimant

can reasonably be expected

to replace your total-loss vehicle

with a vehicle that is substantially similar

to your total-loss vehicle.

Substantially similar means:

same make, same model,

same model year, same trim level,

same major options, similar mileage,

and same or better condition.

Hence, actual cash value

does not mean enough money

to purchase a brand new vehicle

of the same make, same model,

same trim level, same major options,

zero mileage, and perfect condition.

In the definition of actual cash value,

the phrase “can reasonably be expected”

implies that the cost to you

to replace your total-loss vehicle

is uncertain.

How do you calculate an uncertain value?

For example,

if I hand you a fair, six-sided die

and I ask you what value you will get

if you roll that die one time,

you don’t know.

The outcome is uncertain.

You could roll a 1.

You could roll a 2.

You could roll a 3.

You could roll a 4.

You could roll a 5.

You could roll a 6.

Psychologically, you might be tempted

to guess.

If you’re an optimist, you might say,

“Oh, I would expect to roll a six—

or at least a five.”

Or, if you’re an pessimist, you might say,

“Oh, I’d probably roll just a two—

or maybe even a one.”

To calculate an expected value,

practitioners of statistics, finance,

law, and business do not guess.

They use a different methodology.

They calculate what is known

in statistics, finance, law, and business

as an expected value.

To calculate the expected value

of an event, you calculate

the probability-weighted average

of the possible outcomes.

In many situations, this calculation

is much simpler than it sounds.

For example, I might ask you:

if you roll an unbiased six-sided die

one time, what is the expected value?

You can calculate that.

If you roll an unbiased six-sided die

one time, there are six possible outcomes.

The six possible outcomes

are 1, 2, 3, 4, 5, and 6.

The probability of each

of these six possbible outcomes

is the same: one in six or ⅙.

To find the expected value

of one roll

of one unbiased, six-sided die,

we multiply the probability

of each possible outcome

times that outcome;

then we sum the six products:

Expected value

= ⅙·1 + ⅙·2 + ⅙·3 + ⅙·4 + ⅙·5 + ⅙·6

= 1/6 + 2/6 + 3/6 + 4/6 + 5/6 + 6/6

= 21/6

= 3.5

The expected value of one roll

of one unbiased, six-sided die

is 3.5

even though, in this example,

that is not a possible outcome.

When possible outcomes all have

the same probability,

then, to get the expected value

of a single event,

you can simply add up

all the possible outcomes

and divide the sum

by the number of outcomes.

To use our same example:

Expected value

= (1 + 2 + 3 + 4 + 5 + 6)/6

= 21/6

= 3.5

Here again, the expected value is simply

the probability-weighted average outcome.

Given this standard procedure

for finding an expected value,

the fairest and ideal way

for an independent valuation corporation

to find the expected value

of your total-loss vehicle

would be to:

-

Gather all the retail prices

for which vehicles substantially similar

to your total-loss vehicle

sold recently at automobile dealerships

in your local market area. -

Sum all those retail prices.

-

Divide the sum

by the number of sales.

The expected value

or actual cash value

of your total-loss vehicle

would be the average

of all those retail sale prices

plus the local sales tax.

While this would be the ideal way

to calculate the actual cash value

of your total-loss vehicle,

ordinarily, it does not work in practice.

Why?

Substantially similar means

same make, same model,

same model year, same trim level,

same major options, similar mileage,

and same or better condition.

Given the large variety of trim levels,

major options, mileages, and conditions

of used vehicles;

few, if any, vehicles

that are substantially similar

to your total-loss vehicle

may have been sold recently

at automobile dealerships

in your local market area.

While the ideal valuation methodology

is not feasible in practice;

J.D. Power comes pretty close.

To calculate the value of a used vehicle,

the J.D. Power valuation calculator

at www.jdpower.com/cars/manufacturers

uses all available data from a large number

of recent sales of similar vehicles

at local automobile dealerships.

From this data, J.D. Power selects vehicles

of the same make, same model,

same model year, and same trim level

as the valuation vehicle.

The J.D. Power calculator takes into account

how the prices of similar vehicles vary

depending on options and mileage.

From this data, the calculator calculates

the average price paid

of a vehicle that is substantially similar

to your total-loss vehicle.

J.D. Power presents its calculations

as a probability distribution.

J.D. Power tells you the range of prices

that 80% of the prices fall into it.

J.D. Power tells you

the probability-weighted average

of those prices.

The average price paid

is the vehicle’s expected value

or expected buy-from-dealer price.

To use the language of the law of many states,

the J.D. Power valuation calculator

calculates the amount of money

for which you can reasonably be expected

to replace your total-loss vehicle

with a vehicle

that is substantially identical

to your total-loss vehicle.

That is, the J.D. Power valuation calculator

calculates your total-loss vehicle’s

actual cash value.

Perhaps of greatest importance to you,

the J.D. Power valuation calculator

is unbiased.

Both buyers and sellers of used vehicles

rely on J.D. Power’s valuations.

J.D. Power’s success as a business

depends on its valuations

being fair to both buyers and sellers

of used vehicles.

Hence, J.D. Power has

a strong financial motive

to be fair

to both buyers and sellers of used vehicles.

To put J.D. Power’s business

and business practices

into courtroom language,

you might say that J.D. Power

has motive, means, and opportunity

to produce valuations that are

fair to buyers of used vehicles,

fair to sellers of used vehicles,

fair to total-loss claimants,

and fair

to automobile insurance companies.

The laws of a few states require

automobile insurance companies

to value total-loss vehicles

at those vehicles’

“fair market values.”

Fair market value is defined as

“the price at which a given property

would change hands

between a willing buyer

and a willing seller,

neither being under any compulsion

to buy or to sell

and both having reasonable knowledge

of relevant facts.”

Because so many buyers and sellers

of used vehicles

rely on J.D. Power for fair valuations,

J.D. Power, in practice,

often becomes the source of choice

for fair market values

of used vehicles and total-loss vehicles.

If you live in one of the states that require

automobile insurance companies

to value total-loss vehicles

at their fair market value,

you can propose

to the automobile insurance company

that they use

the J.D. Power Buy from Dealer price

as your total-loss vehicle’s

fair market value.

Your total-loss vehicle’s

actual cash value

and fair market value

are the same amount of money—

the J.D. Power Buy from Dealer price

plus sales tax.

Remember: No matter what

automobile insurance company reps say

to try to confuse you,

your total-loss vehicle’s

actual cash value

is an average of prices

of all substantially similar vehicles

sold recently at automobile dealerships

in your local market

plus sales tax.

Your total-loss vehicle’s

actual cash value is not

the lowest price

for which a similar vehicle sold.

Your total-loss vehicle’s

actual cash value is not

the lowest price

for which a similar vehicle is for sale.

Your total-loss vehicle’s

actual cash value is not

the lowest amount of money

that the laws of your state

allow the automobile insurance company

to offer you.

“Jerry, why must you

keep harping

on the sales tax?

“Don’t the automobile insurance companies

know that they’re supposed to include

sales tax in the vehicle’s valuation amount?”

Oh, they know it all right!

But that doesn’t necessarily mean

that the automobile insurance company

will include the sales tax

in your settlement check

unless you make sure that they do.

An automobile insurance company

can save itself a big hunk of dough

if it repeatedly “forgets”

to include the sales tax

in its settlements

of total-loss automobile insurance claims.

One automobile insurance company

recently agreed to pay total-loss claimants

$788,220 after it got nabbed

screwing those total-loss claimants

out of the sales-tax portions

of the valuations of their total-loss vehicles.

actual_cash_value_is_an_expected_valueChapter

What is the best way to think

the valuation of your total-loss vehicle

in a CCC market valuation report?

Most likely, the valuation amount

in a CCC market valuation report

is the lowest offer allowed by law.

To maximize their company’s profits,

the automobile insurance company

that you are dealing with

would like to settle

your total-loss claim

for as little money as possible.

To settle your total-loss claim

for as little money as possible,

the automobile insurance company

would like to offer you

as little money

as they can get away with

in their initial valuation offer

for your total-loss vehicle.

Is there a lower limit

to how little money

the automobile insurance commpany

that you are dealing with

can offer you

in their initial valuation offer?

In many states, yes.

In many states,

to set a lower limit

on initial valuation offers,

insurance regulations

identify half a dozen or so sources

that an automobile insurance company

may use as the source

of its initial valuation offer.

The regulations say

that the automobile insurance company’s

initial valuation offer cannot be lower

than the lowest of the valuation amounts

from these sources.

Often, in many states,

the permissible valuation source

that reliably produces

the lowest valuation amount

is CCC Information Services

a.k.a. CCC Intelligent Solutions.

As far as I have been able to find out,

CCC produces valuations

only for automobile insurance companies.

A valuation services vendor

that produces valuations

only for automobile insurance companies

has a strong financial motive

to produce valuations

that undervalue total-loss vehicles.

To produce its valuations,

CCC uses

a proprietary computerized database

and proprietary software.

A proprietary computerized database

means that only CCC

knows what data is in its database.

Proprietary software

means that only CCC

knows what rules and algorithms

are programmed into its software.

A valuation services vendor

that uses a proprietary database

and proprietary software

has the means

to produce valuations

that undervalue total-loss vehicles.

When such a valuation services vendor

uses their proprietary database

and proprietary software to value

a total-loss claimant’s

total-loss vehicle,

that database and software likely gives

the valuation services vendor

many opportunities

to undervalue

the claimant’s total-loss vehicle.

In sum,

when an automobile insurance company

hires a valuation services vendor

that produces valuations

only for automobile insurance companies

and that valuation services vendor

uses a proprietary database

and uses proprietary software

to value your total-loss vehicle,

then that valuation services vendor

has motive, means, and opportunity

to undervalue your total-loss vehicle.

In some states, the law says

that an automobile insurance company

“may settle” a total-loss claim

on the basis of a valuation

that it got

from one of the permissible sources.

“May settle” does not mean

that the automobile insurance company

has the right or the power

to impose a lowball settlement on you.

“May settle” means

that the automobile insurance company

may enter into settlement negotiations

with you on the basis

of the lowball valuation

that they got

from a valuation services vendor

that produces valuations

only for automobile insurance companies.

It’s up to you to exercise your rights.

It’s up to you to fight back.

insurer_s_offer_is_lowest_offer_allowed_by_lawChapter

To persuade

the automobile insurance company

to value my total-loss vehicle

at its J.D. Power Buy from Dealer price,

I would write a letter

to the automobile insurance company.

In the letter that I would write

to the automobile insurance company:

-

I would find fault

with the valuation methodology

that the automobile insurance company’s

valuation-services vendor

used to produce their valuation

of my total-loss vehicle.I might argue that

the automobile insurance company’s

valuation offer

is a flawed, lowball valuation opinion

produced

by a valuation services vendor

that produces valuation opinions

only for automobile insurance companies. -

I would reject

the automobile insurance company’s

valuation offer. -

I would propose a fair valuation

of my total-loss vehicle.I would propose

that the automobile insurance company

value my total-loss vehicle

at my total-loss vehicle’s

J.D. Power Buy from Dealer price. -

I would argue

for the fairness and legitimacy

of the valuation that I propose.I would argue

that the J.D. Power Buy from Dealer price

for my total-loss vehicle

is a fair and unbiased calculation

of my total-loss vehicle’s

actual cash value.

Some parts of my letter would be different

depending on whether my total-loss claim

was a first-party claim or a third-party claim.

If you want to write such a letter,

then, depending on your personality

and on your situation,

you may prefer to write

a polite letter

to the automobile insurance company,

or you may prefer to write

a more muscular letter

to the automobile insurance company.

Let’s first look at the sort of letter

that I would write

to the automobile insurance company

if I wanted to write a polite letter.

Then, let’s look at the sort of letter

that I would write

if I wanted to write a more muscular letter.

I hope that these examples

of what I might write

will help you think through and figure out

what you might want to say

in your letter

to the automobile insurance company

that you’re dealing with.

In case you want to use

what I would write

as a starting point for your letter,

when the time comes,

I will offer you .docx versions

of my letters.

I will offer you letters

that I might write

for a first-party claim.

I will offer you letters

that I might write

for a third-party claim.

I will offer you suggestions

on your preparation of your letter.

to_persuade_write_a_letterChapter

To make what I would do today

easy to follow, let’s work with

a make-believe insurance company,

a make-believe total-loss vehicle,

a make-believe total-loss claim,

and a make-believe

valuation-services vendor.

To walk you through

what I would do today

to get a fair valuation

of my total-loss vehicle

if I had not yet settled my claim,

let’s work with a make-believe example.

Let’s pretend

that the automobile insurance company

is ABC Automobile Insurance Company.

Let’s pretend

that my total‑loss vehicle

is a 2019 Jeep Cherokee Overland,

VIN number 1C4PJMJX2KD249619.

At the time of the total-loss event,

my total-loss vehicle

had 35,082 miles on its odometer.

Let’s pretend

that, at the time of the total-loss event,

my total‑loss vehicle

was in good condition.

It had no accidents reported

in its CarFax vehicle history.

Let’s pretend

that ABC Automobile Insurance Company

paid ZZZ Valuation Services

to concoct a market valuation report

for my total‑loss vehicle.

Let’s pretend

that the ZZZ market valuation report

substantially undervalued

my total‑loss vehicle.

Let’s pretend

that ZZZ’s market valuation report

is chock full of omissions, errors,

and misrepresentations.

Let’s pretend that,

to value my total-loss vehicle,

ZZZ used a dodgy proprietary database

and dodgy proprietary computer software.

Let’s pretend

that ABC’s advertising slogan is

“Peace of mind is as easy as ABC.”

Nota Bene:

ABC Automobile Insurance Company,

ZZZ Valuation Services,

both companies’ employees,

and all actions attributed to them

in this work of art are entirely fictitious.

No identification with actual companies,

actions, events, or persons (living or dead)

is intended or should be inferred.

Any similarity to actual companies,

actions, events, or persons (living or dead)

is purely coincidental (and deeply troubling).

No animals were harmed in the production

of this work of art.

Let_s_work_with_a_make_believe_total_loss_claimChapter

If I wanted to write a polite letter

to the automobile insurance company,

then my letter

and its supporting documents

might look something like this.

If I wanted to write a polite letter

to the automobile insurance company,

then I would write a letter

something like this one.

Or, if the automobile insurance company

was only trying to cheat me

out of a few hundred dollars,

then I likely would rely upon

a letter like this one.

The letter below is still in the draft stage

of development.

Right now,

the docx version of the letter

is developed further

than the version below.

To help me continue my work,

send me a few dollars.

Thank you!

Jerry Marlow

Jerry Marlow

3 Washington Square Village

New York, NY 10012

July 4, 202_

Ms. Jesse Jones

Claim Settlement Representative

ABC Automobile Insurance Company, Inc.

666 Fleece Street, Suite 666

Flimflam City, NY 10000

Re: Claim # 123456

Dear Ms. Jones,

I hope you are having a swell day.

I reviewed the valuation offer

that you sent to me for my total-loss vehicle.

When I searched at automobile dealerships

for vehicles that are substantially similar

to my total-loss vehicle,

none of the substantially similar vehicles

that I found for sale

were for sale for anywhere near

as little money as the ZZZ valuation.

The prices of the substantially similar vehicles

that I found were all very close to $30,000

(sales tax not included).

Their average price seemed to be

right around $30,000 (sales tax not included).

That average price of $30,000 is well above

the amount of money

at which ZZZ Valuation Services

valued my total-loss vehicle.

ZZZ must have made

some sort of data-processing

or computational error.

If my claim were a third-party claim,

then I would add to the letter here

the following sentence.

A settlement based on ZZZ’s valuation amount

certainly is not going to “make me whole”

for the loss of my vehicle

as the law of negligence torts requires.

Accordingly, I do not accept ZZZ’s valuation.

I do not accept ABC’s valuation offer.

I do not propose that,

to value my total-loss vehicle,

we use the price of one

of the substantially similar vehicles

that I found for sale

at an automobile dealership

because none of those vehicles

are for sale at local automobile dealerships.

Instead, I propose that we use

the J.D. Power valuation

of my total-loss vehicle.

If I was able to verify

that my state’s commissioner of insurance

recognizes J.D. Power

as an authorized source of valuations

for total-loss vehicles,

then I would add to the letter here

the following sentence.

I understand that

our state’s commissioner of insurance

recognizes J.D. Power

as an authorized source of valuations

for total-loss vehicles.

If my claim were a first-party claim,

then I would add to the letter here

the following sentence.

In my automobile-insurance-policy contract,

I read that ABC promises,

in the event of a total loss,

to value my total-loss vehicle

at its actual cash value.

The J.D. Power Buy from Dealer price

for my total-loss vehicle appears to be

a fair, accurate, and reasonable calculation

of my total-loss vehicle’s actual cash value.

The J.D. Power Buy from Dealer price

for my total-loss vehicle is $29,976

(sales tax not included).

Hence, I propose that ABC value

my total-loss vehicle at $29,976

(sales tax not included).

To substantiate this valuation, to the email

to which this letter was attached,

I have attached the J.D. Power valuation

for my total-loss vehicle,

the Monroney Label window sticker

for my total-loss vehicle (which I used

to obtain the J.D. Power valuation),

and a printout of the vehicle specs and options

that I used to produce the J.D. Power valuation.

If you and your colleagues agree

to the J.D. Power valuation,

then we can settle my claim

quickly, easily, and amicably.

Please respond to my valuation proposal

via email or letter.

I do not wish to negotiate

the settlement of my claim over the telephone.

I hope that ABC will settle my claim quickly,

reasonably, fairly, and in good faith.

I hope that ABC’s advertising slogan

is sincere, honest and true:

“Peace of mind is as easy as ABC.”

Thank you.

I look forward to hearing from you.

With best personal regards,

Jerry Marlow

To send my letter to ABC,

I would write a brief email like this one.

I would attach my letter

and supporting documents to the email.

To: j.jones@abcautomobileinsurance.com

From: jerrymarlow@jerrymarlow.com

Claim # 123456 response to your valuation offer

Dear Ms. Jones,

I hope you are well.

To this email, I have attached a letter in which I respond to your valuation offer for my total‑loss vehicle.

My letter is the first attachment, Claim_123456_Jerry_Marlow_Response_to_ABC_s_valuation_offer.pdf.

It appears that ZZZ must have made some sort of error or errors in its valuation of my vehicle.

Hence, I cannot agree to ZZZ’s valuation amount.

I propose that we use a different valuation source.

I propose that we use my total‑loss vehicle’s J.D. Power retail valuation of $29,976 (sales tax not included).

To this email, I have also attached: the J.D. Power valuation of my total‑loss vehicle, the Monroney Label window sticker for my total‑loss‑vehicle, and a PDF of the vehicle specs used to produce the J.D. Power valuation of my total‑loss vehicle.

Please respond to my valuation proposal via email or letter.

I do not wish to negotiate the settlement of my claim over the telephone.

I look forward to hearing from you.

With best personal regards,

Jerry Marlow

Attachments:

Claim_123456_Jerry_Marlow_Response_to_ABC_s_valuation_offer.pdf

(The letter you write goes here.)

Total_loss_Vehicle_1C4PJMJX2KD249619_JD_Power_Value_$29,976.pdf

Total_loss_Vehicle_1C4PJMJX2KD249619_Monroney_Label_window_sticker.pdf

Total_loss_Vehicle_1C4PJMJX2KD249619_JD_Power_Specs.pdf

Click on and take a look

at the three supporting documents

attached to the email.

In particular, note that,

to find the average price paid

for vehicles substantially similar

to my total-loss vehicle,

J.D. Power used price data

for 192 similar vehicles.

When you get the J.D. Power valuation

for your total-loss vehicle,

take note of the number of vehicles

from which J.D. Power used price data

to find the average price paid

for vehicles substantially similar

to your total-loss vehicle.

How many comp vehicles did

J.D. Power use

to value your total-loss vehicle?

How many comp vehicles did

the automobile insurance company use

to value your total-loss vehicle?

A large, unbiased data sample produces

a far more reliable result

than does a small, biased data sample.

A polite letter like this one

with email attachments such as these

very well may get you

the same valuation

that a more muscular letter

would get you.

I do not know and cannot predict

how the automobile insurance company

will respond to any letter.

You may wish to discuss with your co-pilot

the pros and cons of going

with the polite approach.

You may wish to prepare

a polite email and attachments

and then ask an attorney

what she or he thinks

of what you have prepared.

Or you may wish to prepare

both a polite letter

and a more muscular letter

and discuss with an attorney

which one you should send.

Whomever you talk to,

in the end,

rely on your own judgement.

This fight for a fair valuation

is a personal-growth opportunity

for you to make big decisions

and to take responsibility

for those big decisions.

“Uh, ummm, uh, Jerry?

“Why write a letter and an email?

“It’d be easier and simpler

just to put everything in the email.

“Don’t you think?”

Easier and simpler, yes.

Keep in mind, however,

that we’re not just negotiating here.

We’re also creating evidence that,

down the line,

you may wish to use in court

or in an arbitration proceeding.

If you find yourself in

either of those situations,

which mental response

would you rather provoke

in your judge or arbitrator?

“Oh Gawd!

Not another badly formatted email to read!”

Or:

“Oh! A thoughtfully formatted letter to read!”

A_polite_letter_might_look_like_thisChapter

If I decided to write a muscular letter

to the automobile insurance company,

then my letter

and its supporting documents

might look something like this.

If I wanted to write a muscular letter

to the automobile insurance company,

then I would write a letter

something like this one.

I would attach my muscular letter

and its supporting documents

to an email which I would send

to the automobile insurance company.

The letter below is still in the draft stage

of development.

Right now,

the docx version of the letter

is developed further

than the version below.

To help me continue my work,

send me a few dollars.

Thank you!

Jerry Marlow

Jerry Marlow

3 Washington Square Village

New York, NY 10012

July 4, 202_

Ms. Jesse Jones

Claim Settlement Representative

ABC Automobile Insurance Company, Inc.

666 Fleece Street, Suite 666

Flimflam City, NY 10000

Re: Claim # 123456

Dear Ms. Jones,

To reach a fair and amicable settlement

of my total‑loss claim,

ABC Automobile Insurance Company

and I first need to agree

on a fair and reasonable valuation

of my total-loss vehicle.

I have received ABC’s valuation offer

for my total‑loss vehicle.

To the best of my understanding,

ABC Automobile Insurance Company

paid ZZZ Valuation Services

to prepare this market valuation report

for my total‑loss vehicle,

a 2019 Jeep Cherokee Overland,

VIN number 1C4PJMJX2KD249619

with mileage of 35,082 miles.

I reviewed the market valuation report

that ZZZ Valuation Services prepared for you.

ZZZ’s market valuation report

inspires neither trust nor confidence.

Were you to choose to write a similar letter,

here, next, you would need to delete

the sentences that I made up

about how ZZZ describes

its market valuation report

and replace those sentences

with similar sentences

that you copy and paste

from the market valuation report

that you received

from the automobile insurance company

that you’re dealing with.

In one section, the document describes itself

as a Market Valuation Report:

“ZZZ Valuation Services has prepared

this Market Valuation Report

for the exclusive use

of ABC Automobile Insurance Company.

“No other person or entity

is entitled to rely

upon this Market Valuation Report

or on any of its contents.

“No other person or entity should rely

upon this Market Valuation Report

or on any of its contents.

“ZZZ is one source of vehicle valuations.

Other sources of valuations are available.”

By thus calling itself a Market Valuation Report,

the document appears to be trying to sound

authoritative and unbiased.

Yet, in another section, the document

describes itself as merely an opinion

or as a reflection of an opinion:

“The ZZZ Market Valuation Report

reflects ZZZ Valuation Services Inc.’s opinion

as to the value of the loss vehicle,

based on information

that ABC Automobile Insurance Company

provided to ZZZ.”

By calling itself merely an opinion

or a reflection of an opinion,

the document sounds like ZZZ

wishes to evade responsibility

for the accuracy of its work product.

I found this switching back and forth

between authoritative language

and evasive language

to be contradictory and confusing.

Nonetheless, from ZZZ’s market valuation report, I understand that:

-

ABC Automobile Insurance Company

provided ZZZ with the description

of my total-loss vehicle

upon which ZZZ based its valuation.ABC’s description

of my total‑loss vehicle

included an abundance of representations

as to my total-loss vehicle’s VIN, mileage,

specs, major options, and condition

at the time of the total-loss event. -

To come up with its valuation

of my total-loss vehicle,

ZZZ relied upon

the completeness and accuracy

of ABC’s representations

in its description

of my total-loss vehicle. -

ZZZ’s valuation is merely an opinion

or a reflection of an opinion. -

Only ABC Automobile Insurance Company

is entitled to rely on ZZZ’s valuation. -

I am not entitled to rely on ZZZ’s valuation.

-

I should not rely on ZZZ’s valuation.

-

I should not rely on any of the contents

of the ZZZ market valuation report.

That is, I should not rely on the accuracy

or veracity of any of the representations

made in the ZZZ market valuation report. -

It would be prudent of me

to obtain valuations from other sources.

I am so advised.

Thank you!

Did ZZZ have motive, means and opportunity

to undervalue my total-loss vehicle?

ZZZ’s description of its valuation methodology

and the valuation methodology itself

caused me to wonder:

Did ZZZ value my total-loss vehicle

honestly, fairly, and accurately?

Or did ZZZ have

motive, means, and opportunity

to significantly undervalue

my total-loss vehicle?

Let’s explore each

of these red-flag factors in turn.

Motive to undervalue: Profit maximization

Profit maximization is the number-one goal

of most, if not all, C corporations.

Quite likely, ZZZ’s management seeks

to maximize ZZZ’s profits.

Hence, quite likely, ZZZ seeks

to produce market valuation reports

that maximize ZZZ’s profits.

What kind of valuation outcomes

would maximize ZZZ’s profits?

To the best of my understanding,

ZZZ sells its vehicle-valuation services

only to automobile insurance companies.

Hence, to maximize its own profits,

ZZZ likely seeks to help its customers—

automobile insurance companies—

maximize their profits.

How can ZZZ help

automobile insurance companies

maximize their profits?

ZZZ can generate market valuation reports

that undervalue

total-loss claimants’ total-loss vehicles.

Every dollar that ZZZ

saves an automobile insurance company

on the valuation

of a claimant’s total-loss vehicle

reduces the automobile insurance company’s

claim-settlement expense by one dollar.

Reductions in claim-settlement expenses

increase an automobile insurance company’s profits dollar for dollar.

Claim-settlement expenses are far and away

an automobile insurance company’s

biggest category of expenses.

Hence, insofar as ABC and ZZZ seek

to maximize their companies’ profits,

ZZZ has a strong financial motive

to produce valuations

that undervalue claimants’ total-loss vehicles

by as much money

as the management of ZZZ

thinks ZZZ can get away with.

Means to undervalue:

A black-box valuation methodology

that lends itself to easy manipulation

of valuation outcomes

As best I was able to figure out

from ZZZ’s market valuation report,

ZZZ uses a proprietary, black‑box,

computerized model to predict the retail price

at which a local automobile dealership

would sell a vehicle

that is substantially similar

to a claimant’s total‑loss vehicle.

To make its prediction,

ZZZ’s black-box model does not use

all the prices

at which substantially similar vehicles

sold recently at local automobile dealerships.

Instead, ZZZ maintains a database of vehicles.

Were you to choose to write a similar letter,

here, next, you would need to delete

the sentences that I made up

about ZZZ’s valuation methodology

and replace those sentences

with the valuation methodology

described in the market valuation report

that you received

from the automobile insurance company

that you’re dealing with.

To predict the retail price

at an automobile dealership

of a vehicle

that is substantially similar

to a claimant’s total-loss vehicle,

ZZZ first selects from its database

a dozen or so somewhat similar vehicles

to use as comp vehicles.

Then, ZZZ makes numerous “adjustments”

to the price of each somewhat similar vehicle

that it selected from its database.

According to the ZZZ market valuation report

that I received for my total-loss vehicle,

ZZZ makes price adjustments

to reflect differences in vehicle attributes—

including mileage, options,

and vehicle condition.

Then ZZZ calculates

“a weighted average of the adjusted values”

of the somewhat similar vehicles

that ZZZ selected from its database.

ZZZ weights its weighted average

based on these factors:

-

Whether ZZZ obtained the data

from advertisements

or from inspection

of the database vehicle. -

Similarity of database vehicle

to total-loss vehicle -

Proximity of the for-sale location

of the database vehicle

to the usual place of garagement

of the total-loss vehicle -

How long ago ZZZ obtained or updated

the information about the database vehicle

This black-box methodology is the means

by which ZZZ can undervalue

a claimant’s total-loss vehicle.

Opportunity to undervalue:

An abundance of opportunities

to reduce the valuation amount

that ZZZ’s valuation methodology produces.

In its valuation methodology,

ZZZ has created for itself

an abundance of opportunities

to misrepresent facts,

bias its selections,

fudge its “adjustments,”

and tilt its weightings—

all in ways that reduce the valuation amount

that its black-box model produces

for a claimant’s total-loss vehicle.

Through intentional “errors and omissions,”

ZZZ can misrepresent

the specifications and options

of a claimant’s total-loss vehicle

in ways that lower

that vehicle’s valuation amount.

Likewise, ZZZ can misrepresent

the specifications and options

of its database vehicles

in ways that lower

a total-loss vehicle’s valuation amount.

To undervalue claimants’ total-loss vehicles,

ZZZ can select from its database

only the somewhat similar vehicles

the prices of which

are at the lower end

of the somewhat-similar-vehicle price range.

ZZZ can include in its database

vehicles that are advertised on the internet

with low click-bait prices—

even though a would-be buyer

cannot actually buy those vehicles

at their low advertised prices.

If ZZZ uses prices of vehicles

that have not yet been sold,

ZZZ may program into its software

to take a deduction

from those vehicles’ list prices

on the questionable assumption

that the actual sales price

of each vehicle

will be less than its list price.

ZZZ can fudge up the vehicle conditions

of its database vehicles

and fudge down the vehicle condition

of a claimant’s total-loss vehicle.

Such double fudging

can reduce a valuation amount significantly.

If I was able to verify

that my state’s laws

limit the mileage differences

between total-loss vehicles

and substantially similar vehicles,

then I would add to the letter here

the following two sentences.

Our state’s laws limit

the mileage differences

between total-loss vehicles

and substantially similar vehicles.

ZZZ can ignore these limitations

and subtract hundreds

or even thousands of dollars

from the value of a claimant’s total-loss vehicle

because ZZZ’s selected database vehicles

have lower mileages.

To produce a low weighted-average valuation,

ZZZ can update information

on low-value database vehicles

so that those low-value vehicles

weigh heavier in its weighted average.

Likewise, ZZZ can inspect

only low-value database vehicles

so that those low-value vehicles

weigh heavier in its weighted average.

These are all simple and obvious ways

in which ZZZ can misrepresent facts,

bias its selections,

fudge its “adjustments,”

and tilt its weightings

to produce low vehicle valuations

for automobile insurance companies.

Clever valuation specialists

and systems developers at ZZZ

may have figured out many more ways

to manipulate their black-box model and its data

to produce low vehicle valuations

for automobile insurance companies.

Did ZZZ have motive, means and opportunity

to undervalue my total-loss vehicle?

A preponderance of evidence

strongly suggests that the answer

to our question is:

“Yes.”

In many states,

the laws that govern

how automobile insurance companies

are required to value total-loss vehicles

and settle total-loss claims

take away a first-party claimant’s right to sue

his or her automobile insurance company

for punitive damages

if his or her automobile insurance company

engages in reprehensible misconduct.

If my claim were a first-party claim

and I lived in a state

that took away my right

to sue my automobile insurance company

for punitive damages,

then I would add to the letter here

the following argument.

Is it fair and realistic of me to suspect

that ZZZ undervalued my total-loss vehicle?

Ordinarily, American consumers presume

that corporations honor contractual obligations

of good faith, honesty, and fair dealings.

Ordinarily, many American consumers

(or their attorneys) know that,

if a corporation breaches

its contractual obligations

of good faith, honesty, and fair dealings

and engages in reprehensible misconduct;

then the consumer can sue the corporation

not only for compensatory damages

but also for punitive damages.

Punitive damages are

on top of compensatory damages.

Punitive damages can be as much as

three times compensatory damages.

Ordinarily, the possibility

of having to pay punitive damages

for engaging in reprehensible misconduct

deters corporations

from engaging in reprehensible misconduct.

Given contractual obligations

of good faith, honesty, and fair dealing

and given the threat of punitive damages

for engaging in reprehensible misconduct,

is it fair and realistic of me to suspect that,

to maximize their company’s profits,

ZZZ might misrepresent facts,

bias selections, fudge “adjustments,”

and/or tilt weightings

to produce low vehicle valuations?

Let’s explore that question.

An automobile insurance policy is a contract

between an automobile insurance company

and the policyholder.

But an automobile insurance policy

is not an ordinary contract.

The regulatory regime

that our state’s legislators

created for automobile insurance companies

that do business in our state

takes away a policyholder’s right

to sue

his or her automobile insurance company

for punitive damages

for engaging in reprehensible misconduct.

Absent the deterrent of punitive damages,

why wouldn’t employees

of automobile insurance companies

and employees

of automobile insurance companies’

valuation services vendors

engage in whatever types of conduct

that they believe will maximize

their companies’ profits?

Also, I am aware that,

in at least one court case,

Milligan v. GEICO Gen. Ins. Co.,

20-3726-cv (2d Cir. Feb. 14, 2022),

an automobile insurance company

and its valuation-services vendor

successfully argued

that the valuation-services vendor

had no contractual obligations

[such as duties of good faith, honesty, and fair dealing]

to the total‑loss claimant because

1) the total‑loss claimant

was not a party to the contract

between the automobile insurance company

and its valuation-services vendor

[lack of privity] and

2) the contract

between the automobile insurance company

and its valuation-services vendor

did not imply that the total‑loss claimant

was a third-party beneficiary of that contract.

At the same time

that a valuation services vendor can argue

that it has no obligation

of good faith, honesty, and fair dealing

to the total-loss claimant,

an automobile insurance company

can argue that it has no responsibility

for the validity of a valuation opinion

that it purchased from another corporation.

Given the free pass

that our state’s legislators have granted

to automobile insurance companies

on punitive damages;

given the free pass

that the law gives

valuation services vendors

on contractual obligations

to a total-loss claimant

of good faith, honesty, and fair dealing;

and given that no one is legally accountable

to the total-loss claimant

for the legitimacy and validity

of a valuation opinion

that an automobile insurance company

buys from a valuation services vendor;

I believe it is both fair and realistic

for me to suspect that,

to maximize their companies’ profits,

ABC or ZZZ or both just might have

misrepresented facts, biased selections,

fudged “adjustments,” or tilted weightings

to produce an unfairly low valuation

for my total-loss vehicle.

ZZZ predicted

that an automobile dealership

would sell a vehicle

that is substantially similar

to my total-loss vehicle

for $24,444 (sales tax not included).

Using the valuation methodology

described above,

ZZZ’s proprietary,

black‑box computerized valuation model

predicted that a vehicle

that is substantially similar

to my total‑loss vehicle

and that is for sale

at a local automobile dealership

will have a retail price of $24,444

(sales tax not included).

How can a total-loss claimant

determine if ZZZ valued

his or her total-loss vehicle

fairly and accurately?

A total-loss claimant has no feasible way

to directly investigate and analyze

ZZZ’s opaque, black-box methodology.

To validate or repudiate

a ZZZ valuation directly,

a total-loss claimant

would have to survey

the entire market

of somewhat similar vehicles.

A total-loss claimant

would have to survey

the marginal difference

that every option on a vehicle

makes to the vehicle’s total value.

A total-loss claimant

would have to survey

the differences in vehicle value

associated with differences

in that vehicle’s mileage.

For every somewhat similar vehicle

in ZZZ’s database,

a total-loss claimant

would have to do due diligence

on every data item.

A total-loss claimant

would have to do due diligence

on every line of computer code

in ZZZ’s valuation software.

A total-loss claimant is unable

to do any of these things—

much less do all of them.

I do not agree with ZZZ’s valuation.

I do not accept ABC’s valuation offer.

Whereas ZZZ had motive, means,

and opportunity

to undervalue my total-loss vehicle,

whereas ZZZ had no legal obligation or duty

to me to produce a fair and honest valuation,

and whereas ABC bears no legal responsibility

for the fairness or honesty

of ZZZ’s valuation of my total-loss vehicle;

I do not agree

to ZZZ’s valuation of my total-loss vehicle.

I do not accept ABC’s valuation offer

of $24,444 (sales tax not included).

Instead, I propose that,

to value my total-loss vehicle,

we use its J.D. Power valuation

of $29,976 (sales tax not included).

J.D. Power is a valuation source

approved by our state’s Commissioner of Insurance.

J.D. Power has no financial motive or incentive

to either undervalue or overvalue

total-loss vehicles.

Both buyers and sellers of used vehicles

rely on J.D. Power’s valuations.

J.D. Power’s success as a business

depends on its valuations

being fair to both buyers and sellers

of used vehicles.

Hence, J.D. Power has

a strong financial motive

to be fair to both buyers and sellers

of used vehicles.

To put J.D. Power’s business

and business practices

into courtroom language,

one might say that J.D. Power

has motive, means, and opportunity

to produce valuations

that are fair to buyers of used vehicles,

fair to sellers of used vehicles,

fair to total-loss claimants,

and fair

to automobile insurance companies.

I obtained and documented

a J.D. Power valuation.

To get the J.D. Power valuation,

I entered my total‑loss vehicle’s mileage

of 35,082 miles

into J.D. Power’s online calculator

at www.jdpower.com/cars/manufacturers.

I entered the vehicle specs and major options

that are on my total‑loss vehicle’s

Monroney Label window sticker.

I entered the zip code

of my total‑loss vehicle’s principal place

of garagement.

J.D. Power’s value calculator reported that,

for 192 recent sales

of similar vehicles

in my local market,

the average selling price was $29,976

(sales tax not included).

The J.D. Power Buy from Dealer price

for my total-loss vehicle

is a fair, accurate, and reasonable calculation

of my total-loss vehicle’s actual cash value.

To substantiate this J.D. Power valuation,

to the email by which I transmitted

this letter to you,

I attached

the J.D. Power valuation

for my total loss vehicle,

the Monroney Label window sticker

for my total loss vehicle

that I used to obtain

the J.D. Power valuation,

and a printout

of the vehicle specs and options

that I used to produce

the J.D. Power valuation.

Whereas the valuation that I propose

is in full, demonstrable, documented,

and verifiable compliance

with our state’s insurance regulations

and with other laws of our state,

I trust that you and your colleagues

will agree that the $29,976 valuation

(sales tax not included)

that I propose is fair to all.

If you and your colleagues agree

to the J.D. Power valuation,

then we can settle my claim

quickly, easily, and amicably.

Please respond to my valuation proposal

via email or letter.

I do not wish to negotiate

the settlement of my claim over the telephone.

Thank you.

I look forward to hearing from you.

With best personal regards,

Jerry Marlow

In_a_first_party_claim_a_muscular_letter_might_look_like_thisChapter

Whaddaya think, my friend?

Did my muscular letter

do anything for you?

As you read it, did you smile?

Did you utter the F word?

Did you get goosebumps?

Did your skin tingle?

I love when my writing

makes people’s skin tingle!

“Well, Jerry, I liked the attitude of the letter.

“Nothing mealy mouthed about it.

“But the letter is so long!

“As I kept reading and reading,

I got frightened that the letter

was never e v e r r r r

going to end!

“My skin did not tingle,

but the hairs

on the back of my neck

did stand up.

“Why write such a long letter?

“Why go into so many issues

in so much detail?

“I’ve never, ever, read

a letter that long before—

much less wrote one!”

Whaddaya_think_my_friendChapter

We write a long letter

because we write

with the eyes

of a judge or arbitrator

in mind.

If you include in your letter

all the arguments

and all the evidence

that you would want

to present in court

if you sue,

then you have almost no work

left to do to prepare to sue

if you need to sue.

If you vet your letter

with an attorney in your county,

then you should be well prepared

to respond to any questions

that your judge

or court arbitrator might ask

if you sue.

If you vet your letter

with an attorney in your county,

then you should be well prepared

to respond to any issues

that the attorney

for the automobile insurance company

might raise

if you sue.

We write a long letter

mostly because we write our letter

for more than one audience.

The obvious audience is the folks

at the automobile insurance company.

But they may not be

your most important audience.

If you end up

going through an appraisal process,

then you can give a copy of your letter

and its supporting documents

to the appraiser that you hire.

The appraiser whom you hire

can show your letter

and its supporting documents

to the third appraiser.

Your letter

and its supporting documents

may win the third appraiser over

to a valuation favorable to you.

If you end up suing

the automobile insurance company

or you end up going through

an arbitration procedure,

then your letter

and its supporting documents

will be important pieces of evidence.

Most likely, your judge or arbitrator,

will read your letter

and look at its supporting documents.

Hence, your letter is an opportunity

to communicate important points—

and your reasonableness—

to your judge or arbitrator.

If you sue

the automobile insurance company

in a small-claims lawsuit,

the judge or small-claims court arbitrator

will not expect you

to cite the laws

on which you base your claims.

In fact, your judge

or small-claims court arbitrator

may not want you to cite any laws.

“Why do you say that?”

Most likely, your judge or arbitrator

will be an attorney.

Attorneys can be a little prickly

about us unwashed ignoramuses

telling them

what the law says.

Hence, if you end up

in a small-claims lawsuit

and your judge

or small-claims court arbitrator

is not acquainted

with your state’s laws and regulations

that govern

how automobile insurance companies

are required to value total‑loss vehicles

and settle total‑loss claims,

then your letter—

your letter offered into evidence—

is an opportunity to, as they say,

“refresh your judge

or small-claims court arbitrator’s memory.”

Also, in a small-claims lawsuit,

the judge or small-claims court arbitrator

will not expect you

to present your argument in writing.

Hence, in a small-claims lawsuit,

your long letter can accomplish

much of what a legal brief

would accomplish

in a large-claims lawsuit.

In your letter,

you can argue your side of the story

in an organized, thorough,

and persuasive way.

If you sue

the automobile insurance company

in a large-claims lawsuit, then, most likely,

the judge who hears your case

will expect you to submit a legal brief.

A legal brief is a written document

in which you state your claims,

make your argument for each claim,

and cite the laws and court cases

that support your argument

for each of your claims.

If you include your citations and arguments

in your letter, then, if and when need be,

you can translate your letter

into a legal brief;

or you can ask your legal coach

to help you translate your letter

into a legal brief;

or you can hire a freelance paralegal

to translate your letter

into a legal brief.

And, my friend,

there’s another angle

to factor into your thinking.

When the folks

at the automobile insurance company

read your long letter,

not only will they read it

through their own eyes;

they’ll also read it

through the eyes of a judge or arbitrator.

If, through the eyes

of a judge or arbitrator,

they see conspiracy to commit fraud

written all over

their collusion

with their valuation services vendor

to misrepresent facts

and undervalue your total-loss vehicle,

then the folks

at the automobile insurance company

may utter the F word.

Every time they discover more evidence

that you are not a gullible,

bumbling, trusting fool;

they may utter the F word

again and again.

Every time they utter the F word,

that may mean

another thousand dollars

added to the valuation

of your total‑loss vehicle.

Let’s get’em to say the F word

as many times as we can.

And so, for these reasons,

my friend,

I favor a long letter.

At least, that’s what I’d do.

“I see.

“Our strategy is

to get the con artists

at the automobile insurance company

to cuss up a blue streak!”

Better to make them curse you

than to let them,

behind your back,

smirk and giggle

about what a fool you are.

So, are you good to go

with a long letter?

“Maybe. We’ll see.”

You are so hard to please!

If you’re still feeling uneasy, my friend,

then maybe you’re a little discombobulated

because you did not expect

the letter

to be so long?

A basic principle of warfare says:

Strategically, do the unexpected.

Tactically, hit your adversary

where he is weakest.

The automobile insurance company

doesn’t expect a long letter either.

Most likely, where

the automobile insurance company

is weakest

is its market valuation report.

If the automobile insurance company

and its valuation services vendor

are trying to screw you

out of thousands of dollars,

then you’re at war.

Or, at least I would be.

I say:

Do the unexpected!

Write a long, powerful, comprehensive letter.

I say:

Hit your adversary where he is weakest.

Attack the automobile insurance company’s

market valuation report.

How ’bout you?

Whose side are you on?

Yours?

Or the automobile insurance company’s?

“Okay! Okay!

“I got your point.”

Good!

Looking at you,

I see you also got

a funny look on your face.

What else is eating at you?

“Well, since you asked …”

We_write_with_the_eyes_of_a_judge_or_arbitrator_in_mindChapter

“Jerry, shouldn’t I ask

the automobile insurance company

to correct the mistakes

in their market valuation report

and re-value my vehicle

with the correct information?”

“In your muscular letter to ABC,

Jerry, I noticed that you did

something real different

from what you and Maria

did in your letters

to the insurance companies.

“In your and Maria’s letters, you told

the automobile insurance companies

about the omissions, errors, misrepresentations,

and defective calculations

in their market valuation reports.

“You and Maria asked

the automobile insurance companies

to correct their mistakes

and to re‑value your vehicles

using the correct information.

“Shouldn’t I do that?”

My friend, my dear, innocent friend;

let’s dig into your observation

and into your question.

The CCC valuation opinions

that Maria and I received

made this request:

“Please review the information

in the Vehicle Information Section

to confirm the reported mileage

and to verify

that the information accurately reflects

the options, additional equipment

or other aspects of the loss vehicle

that may impact the value.”

A request like this is a work of genius!

“How so, Jerry?

“Looks innocuous to me.”

That’s part of its genius!

If the valuation opinion

that you received

makes a request like this

and you are insufficiently wary,

then that request

can accomplish many things!

-

The request that

you “review,” “confirm,” and “verify”

can mislead you into believing

that the automobile insurance company’s

valuation services vendor

is trying to come up with

an honest and accurate valuation. -

If you comply with this request,

then you allow

the automobile insurance company

and its valuation services vendor

to shift responsibility

for the accuracy of their description

of your total‑loss vehicle

from them to you! -

If you allow them

to put the onus for accuracy on you,

then you make yourself susceptible

to the notion that,

with correct information,

the valuation services vendor’s

black-box valuation model

will produce a legitimate valuation.Fat chance of that!

-

Which is to say,

if you correct their omissions and errors,

then, by your engagement

with their valuation opinion,

you legitimize the valuation

that results from your corrections. -

Once you start legitimizing their opinion,

it gets psychologically harder and harder

for you to reject the opinion’s valuation.

This cascade of effects

can set aswirl a psychological whirlpool

that will suck you into the scam

that the automobile insurance company

and its valuation services vendor

are running.

Pretty clever, huh?

“Sounds diabolical.”

Uh huh.

“Do you suspect that

the automobile insurance company

and their valuation services vendor

are possessed by the devil?”

I dunno.

Maybe.

To prep for negotiations with them,

you may want to watch

“The Exorcist” again.

You may want to load

your water pistol

with holy water.

“P s s s s s s s s s s s s !”

I’m embarrassed to admit it,

but I allowed myself

to get sucked

into this diabolical whirlpool twice!

Fool that I was,

I pointed out to Travelers

the omissions and errors

in the description of my totaled vehicle

in CCC's market valuation report.

Doing so did not get me a fair valuation.

Bigger fool that I was,

I suggested to Maria

that she point out

to her automobile insurance company

the omissions and errors

in the description of her totaled vehicle

in the CCC market valuation report

that she received.

She did.

Doing so did not get Maria a fair valuation.

I almost fell for this con job a third time.

When I set to work on wasyourcartotaledorstolen.com,

I planned to suggest to you—

to you, my dear friend—

that you find and correct

the omissions and errors

in the description of your total‑loss vehicle

in the valuation report that you received.

I planned to suggest to you

that you ask

the automobile insurance company

to revalue your vehicle

with your corrections.

But then that voice

finally spoke up.

“Uh, which voice was that, Jerry?”

That voice that dwells within each of us—

that voice that—

however long it may take—

finally speaks up

when we’ve been suckered

one time

too many.

That voice said:

“Wait a gol dern minute, here!

“Hold your galloping horses!

“Your horses are headed off a cliff!

“If an automobile insurance company

actually wanted accurate descriptions

of total‑loss vehicles,

then they would train

their claims adjusters

to provide accurate descriptions.

“If an automobile insurance company

and its valuation‑services vendor

actually wanted to know

what options were on total‑loss vehicles,

then they would pull Monroney Labels

on those vehicles.

“If an automobile insurance company

actually wanted to come up

with fair valuations for total-loss vehicles,

then they would use a valuation source

that both buyers and sellers

of used vehicles trust.”

With these epiphanies,

I experienced a cascade

of further realizations:

I was not responsible

for the accuracy

of Travelers’s description

of my vehicle

in their valuation opinion for my vehicle.

They were!

Maria was not responsible

for the accuracy

of her automobile insurance company’s

description of her vehicle

in their valuation opinion for her vehicle.

They were!

You are not responsible

for the misrepresentations and defects

in the automobile insurance company’s valuation opinion.

The automobile insurance company is!

If you try to correct

the automobile insurance company’s

omissions, errors, defects,

and misrepresentations;

and you try to correct

the valuation services vendor’s

omissions, errors, misrepresentations,

and defective calculations;

then you’ll be digging your own grave.

Those omissions, errors,

misrepresentations,

and defective calculations

are your evidence

of the automobile insurance company’s

reprehensible bad‑faith misconduct.

That evidence

of the automobile insurance company’s

reprehensible bad‑faith misconduct

could be your ticket

to winning a lawsuit

or an arbitration proceeding.

Why on earth

would you want to correct

those omissions, errors,

misrepresentations,

and defective calculations?

“Got it, Jerry!”

Shouldn_t_I_ask_the_insurance_company_to_correct_their_mistakesChapter

I would write a brief email to

ABC Automobile Insurance Company.

To the email, I would attach:

-

My muscular letter

-

The J.D. Power valuation

of my total-loss vehicle -

The Monroney Label window sticker

for my total-loss vehicle -

A PDF of the vehicle specs

used to produce

the J.D. Power valuation

To send my muscular letter

and its supporting documents

to the automobile insurance company,

I would write a brief email.

I would attach my muscular letter

and its supporting documents to the email.

My email and its attachments

would look something like this.

To_send_the_muscular_letter_to_ABC_I_write_an_emailChapter

To: j.jones@abcautomobileinsurance.com

From: jerrymarlow@jerrymarlow.com

Claim # 123456 response to your valuation offer

Dear Ms. Jones,

I hope you are having a wonderful day.

To this email, I have attached a letter in which I respond to ABC Automobile Insurance Company’s offer to value my total‑loss vehicle at $24,444 (sales tax not included).

My letter is the first attachment, Claim_123456_Jerry_Marlow_s_response_to_ABC_s_valuation_offer.pdf.

In my letter, I reject ZZZ’s valuation.

I explain in detail why I reject ZZZ’s valuation.

Because ABC’s valuation offer is based on ZZZ’s valuation,

I do not agree to ABC’s valuation offer.

Instead, I propose that, to value my total‑loss vehicle, we use my total‑loss vehicle’s J.D. Power retail valuation of $29,976 (sales tax not included).

To this email, I have also attached: the J.D. Power valuation of my total‑loss vehicle, the Monroney Label window sticker for my total‑loss‑vehicle, and a PDF of the vehicle specs used to produce the J.D. Power valuation of my total‑loss vehicle.

Please respond to my valuation proposal via email or letter.

I do not wish to negotiate the settlement of my claim over the telephone.

I look forward to hearing from you.

With best personal regards,

Jerry Marlow

Attachments:

Claim_123456_Jerry_Marlow_s_response_to_ABC_s_valuation_offer.pdf

(The letter you write goes here.)

Total_loss_Vehicle_1C4PJMJX2KD249619_JD_Power_Value_$29,976.pdf

Total_loss_Vehicle_1C4PJMJX2KD249619_Monroney_Label_window_sticker.pdf

Total_loss_Vehicle_1C4PJMJX2KD249619_JD_Power_Specs.pdf

Think about a letter like mine

and its supporting evidence

from the other side.

Imagine that you work

for an automobile insurance company

as a claims agent.

Imagine that you receive this email,

letter, and supporting documents.

What would you choose to do?

Would you choose to do all the reading,

analysis, and other work necessary

to push back?

Or would you choose to say

what Maria’s claims agent chose to say?

Maria’s claims agent said,

“Okay.

“We can use your valuation.”

To_send_the_muscular_letter_to_ABC_I_write_an_emailChapter

Nota bene

Jerry Marlow is not an attorney. Neither information nor opinions published on this site constitute legal advice. This site is not a lawyer referral service. No attorney‑client or confidential relationship is or will be formed by use of this site. Any attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service.

Terms of use

Jerry Marlow grants human users of wasyourcartotaledorstolen.com permission to use the copyrighted materials on wasyourcartotaledorstolen.com for their personal use free of charge.

The fee to use copyrighted materials on wasyourcartotaledorstolen.com to train artificial intelligence software (AI) is $4 million.

Reproduction of copyrighted materials on wasyourcartotaledorstolen.com for commercial use without the written permission of Jerry Marlow is strictly prohibited.

Jerry Marlow does not grant users permission to reproduce on other websites any of the copyrighted material published on wasyourcartotaledorstolen.com.

Jerry Marlow does not grant users permission to reproduce via audio, video, or any other audiovisual medium any of the copyrighted material published on wasyourcartotaledorstolen.com.

If you wish to use any of the copyrighted material published on wasyourcartotaledorstolen.com in any way for which permission is not explicitly granted, contact Jerry Marlow at jerrymarlow@jerrymarlow.com.