Support my crusade!

The purpose

of an automobile insurance company

is supposed to be to redistribute risk.

Year in and year out,

you and other policyholders pay

automobile insurance premiums.

You pay those premiums so that,

if your automobile is totaled or stolen

or if you are liable for the total-loss

of another motorist’s vehicle;

then you will not have to absorb

an enormous financial loss

all at once.

Instead of you absorbing the risk

from your own financial assets,

your automobile insurance company

or the other driver’s

automobile insurance company

will pay for the loss

from the insurance premiums

that it has collected.

That is the beneficial concept

of any insurance company.

Insurance companies grew

out of mutual aid societies.

Citizens would band together to share risks

and help one another get through setbacks

without suffering ruinous financial loss.

Mutual aid societies

were owned by and run by their members.

In recent times, however,

things have changed.

Today, automobile insurance companies

are owned by their shareholders.

Greedy, unethical

automobile insurance companies

have re-engineered their companies.

Their purpose in society is no longer

to be a mechanism of mutual aid.

Their business purpose

is no longer to redistribute risk.

Today the business purpose

of automobile insurance companies

is to redistribute wealth—

to redistribute wealth from you

and from other policyholders

to the automobile insurance company’s

CEO, other executives, and shareholders.

The more money they can cheat you out of,

the more of your money

they can redistribute

to their CEO, to their other executives,

and to their shareholders.

If my experience with Travelers

and Maria’s experience

with her automobile insurance company

are typical

of how automobile insurance companies

treat total-loss claimants,

then automobile insurance companies

are trying to cheat

hundreds of thousands

of total-loss claimants

out of hundreds of millions of dollars

every year.

Does knowing

that automobile insurance companies

regularly cheat everyday Americans

out of thousands of dollars

on their total-loss claims

make you mad?

Makes me mad.

Even makes me a little crazy.

Makes me so mad

that my work to save you

and other Americans

from getting ripped off

by automobile insurance companies

has transubstantiated into a crusade.

Makes me crazy enough that,

to create this first version

of wasyourcartotaledorstolen.com,

I’ve gone through my life’s savings

and run up the balances on my credit cards.

In this first version

of wasyourcartotaledorstolen.com,

I sound the alarm

on automobile insurance companies

and valuation-services vendors

that routinely cheat total-loss claimants

out of fair valuations

of their total-loss vehicles.

I explain why they cheat you,

how they cheat you,

and what you can do about it.

I show you what Maria and I did

to get fair valuations

of our total-loss vehicles.

I tell you what I would do today.

I show you the letters that I would write

to the automobile insurance company.

I show you the emails that I would write.

I show you the supporting documents

that I would attach to the emails.

I show you how you can create

similar supporting documents

for your total-loss vehicle.

I explain how, you can use

our government-subsidized court system

to sue the automobile insurance company

that you’re dealing with.

I suggest that,

with the guidance of a legal coach,

you can easily represent yourself

in a small-claims lawsuit.

I suggest that,

with the guidance of a legal coach

and with help preparing a legal brief,

you can represent yourself

in a large-claims lawsuit

I want you to be able to do

what Maria and I did

to get fair valuations

of our total-loss vehicles.

I hope that this first version

of wasyourcartotaledorstolen.com

helps you catch on to what

the automobile insurance company

that you’re dealing with is up to.

I hope that this first version

of wasyourcartotaledorstolen.com

helps you

get a fair valuation

of your total-loss vehicle.

But I don’t want to stop here.

Support_my_crusadeChapterAnchor

Support_my_crusadeChapter

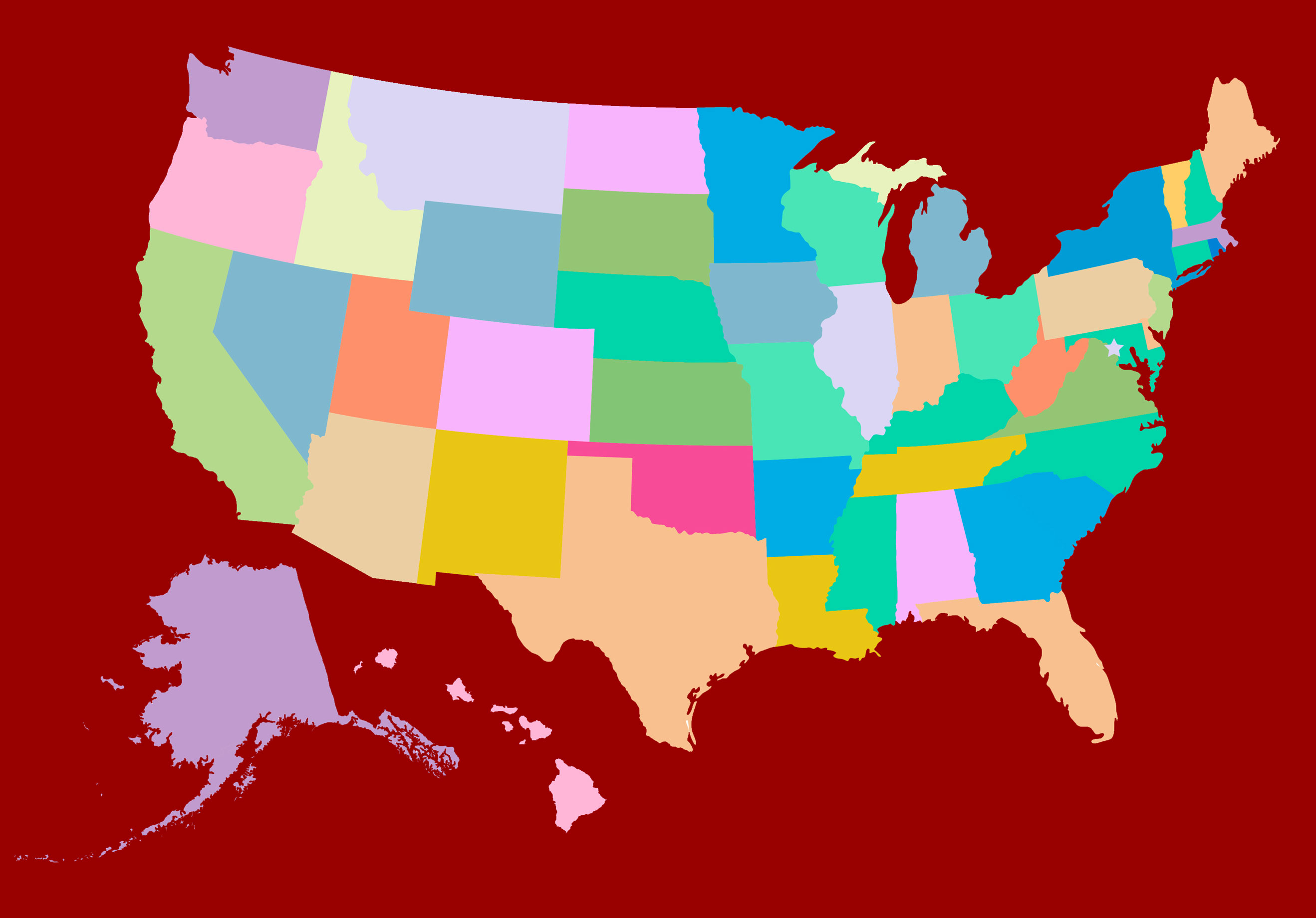

Help me teach you

and other total-loss claimants

what I would do

state by state

to get a fair valuation

of my total-loss vehicle

in every state in the USA

plus in the District of Columbia.

I have begun work

on an expanded, state-by-state version

of wasyourcartotaledorstolen.com.

In the expanded version,

I plan to copy and paste

to wasyourcartotaledorstolen.com

the most relevant laws

that every state’s legislators

have passed to govern

how automobile insurance companies

that do business in that state

are required to value total-loss vehicles

and settle total-loss claims.

I intend to do what I can

to make those laws

easy to understand.

I plan to teach you state by state

what I would do today

to get a fair valuation

of my total-loss vehicle in your state.

In model letters for every state,

I intend to show you

which parts of your state’s laws

I would insert into my letters

to the automobile insurance company.

If you have a right of recourse,

I intend to show you how I would exercise

a right of recourse in your state.

I plan to tell you what your state’s

statute of limitations for negligence tort is.

I plan to tell you what your state’s

statute of limitations for breach of contract is.

I have invited attorneys in your county

who would like to be your legal coach

to advertise their services

on wasyourcartotaledorstolen.com

in a county-by-county listing

for your state.

I intend to do whatever else I can think of

to help total-loss claimants

get fair valuations of their total-loss vehicles.

To keep working

on wasyourcartotaledorstolen.com,

I need Americans

who are fed up with getting ripped off

by automobile insurance companies

to support my crusade.

I need Americans who believe in justice

to support my crusade.

If you would like to help me

continue my work

and continue my crusade,

send me a few dollars.

No amount is too little.

No amount is too much.

Any amount will tell me

that you want me

to carry on my crusade.

The Supreme Court has ruled

that money is speech.

Speak up!

Make yourself heard!

To send me a few dollars,

at the top right of your screen,

With your help, I’m just getting started!

Thank you, my friend!

Jerry Marlow

help_me_build_state_by_state_versionSubchapter

Nota bene

Jerry Marlow is not an attorney. Neither information nor opinions published on this site constitute legal advice. This site is not a lawyer referral service. No attorney‑client or confidential relationship is or will be formed by use of this site. Any attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service.

Terms of use

Jerry Marlow grants human users of wasyourcartotaledorstolen.com permission to use the copyrighted materials on wasyourcartotaledorstolen.com for their personal use free of charge.

The fee to use copyrighted materials on wasyourcartotaledorstolen.com to train artificial intelligence software (AI) is $4 million.

Reproduction of copyrighted materials on wasyourcartotaledorstolen.com for commercial use without the written permission of Jerry Marlow is strictly prohibited.

Jerry Marlow does not grant users permission to reproduce on other websites any of the copyrighted material published on wasyourcartotaledorstolen.com.

Jerry Marlow does not grant users permission to reproduce via audio, video, or any other audiovisual medium any of the copyrighted material published on wasyourcartotaledorstolen.com.

If you wish to use any of the copyrighted material published on wasyourcartotaledorstolen.com in any way for which permission is not explicitly granted, contact Jerry Marlow at jerrymarlow@jerrymarlow.com.